insurance affordable insured car cheap insurance business insurance

insurance affordable insured car cheap insurance business insurance

cheap auto insurance insure perks cheapest

cheap auto insurance insure perks cheapest

liability cheapest auto insurance insurance companies cheaper car insurance

liability cheapest auto insurance insurance companies cheaper car insurance

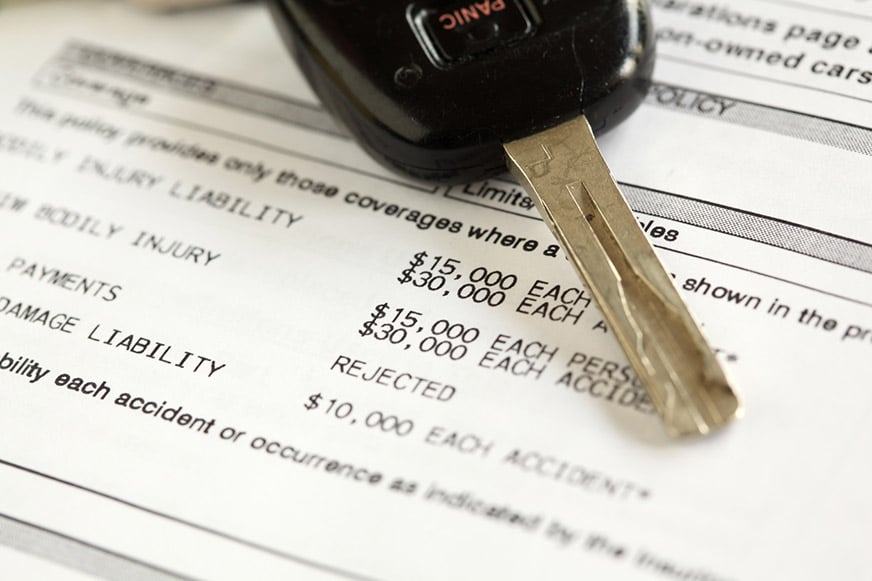

Each state has minimum insurance needs, yet most states require much much less insurance coverage than you need to shield on your own and also your possessions (auto insurance). Compare Insurance Policy Rates, Guarantee you are obtaining the best price for your insurance. Contrast quotes from the leading insurer. Liability Insurance coverage vs. Car Worth and also Possessions, When it pertains to automobile insurance coverage, there are 2 significant types of coverage: obligation, which covers damage you might do to another person and also their property, and every little thing else, which covers damage that takes place to your property (cheap).Liability-only car insurance coverage is less costly and is a protection requirement in nearly every state, with each state mandating its own minimum coverage degrees. Some states have reduced responsibility minimums, with The golden state and Pennsylvania needing just$5,000 for residential or commercial property damage coverage. The most intelligent point for vehicle drivers is to increase their obligation degrees as high as they can moderately pay for to go. If you are at fault in a crash and wound somebody else or harm their residential or commercial property, you will be held accountable for their costs (insured car). What states do not call for vehicle insurance? New Hampshire is the only state that does not call for insurance coverage, but it does, nonetheless, require you to show you can meet the New Hampshire minimal economic responsibility requirements in the event of a mishap. Each state has different laws relating to obligation insurance demands, with some requiring without insurance motorist insurance coverage or personal injury protection, and others calling for just physical injury and also home damages liability - cars. It is necessary to stay up to day on your state's laws and policies to ensure you remain to satisfy their requirements. Just How Much Vehicle Insurance Policy Insurance Coverage Do You Need? and just how much vehicle insurance is called for are 2 very various questions. State needs are commonly much lower than the quantity necessary to protect you monetarily in case of an accident. If you have a financing on your lorry, your lender may call for thorough and also crash protection. Various other insurance coverages, like void insurance coverage or windscreen insurance coverage, may additionally be demands by your loan provider to make certain you are securing their financial investment. These coverages are likewise a great concept if you can not manage to replace your car if it is totaled or might not afford a major repair out-of-pocket. In the table below, you can see the insurance coverage level prices for state-minimum liability-only coverage, state-minimum thorough and also collision insurance coverages with a$ 1,000 deductible and the 100/300/100 thorough and also collision with a$1,000 deductible. You can also utilize Cash, Geek's to get a more specific price quote based on your age, vehicle and driving history. Accident: Accident insurance coverage pays for problems to your car when you are at mistake in an accident. If you have a financing on your vehicle, your loan provider might call for energetic accident insurance on your plan. Comprehensive: Comprehensive insurance covers damages to your auto that isn't an outcome of a crash. 300 The 2nd number in your responsibility protection is the optimum amount your insurance policy firm will certainly spend for physical injury cases for a complete mishap. This does not supersede your per individual maximum, nevertheless. So if you hit someone and also they need $126,000 in treatment, you will certainly be liable for the additional$26,000 above your $ 100,000 each restriction, despite the fact that you have a per crash optimum of $300,000. In this circumstances, the 100 stands for$100,000 in protection (cheaper auto insurance). If you can't afford a minimum of 100/300/100 in liability coverage, you could still wish to select the highest possible quantity of coverage you can afford. vehicle. If 50/100/50 is the highest possible you can go, you could wish to pick that rather of skipping to the state minimums. There are some pricey cars and trucks when traveling, and the ordinary accident settlement in an auto accident is$ 52,900. Having higher degrees of insurance is an integral part of safeguarding on your own financially.

cheaper car insurance suvs car cheaper cars

cheaper car insurance suvs car cheaper cars

What States Require Added PIP and also Insurance Coverage? There are many several kinds car cars and truck coverage availableReadily available includingConsisting of Umbrella PolicyPlan If you don't think that the highest highest possible of bodily physical and as well as damage liability responsibility be enough sufficient protect secure assets possessions a severe extreme, you might may to purchase buy umbrella policyPlan Commonly, you can choose anywhere from $100 to $1,000 as your deductible quantity: the higher your deductible, the lower your regular monthly insurance coverage premium.

Compare Automobile Insurance Policy Rates, Guarantee you are getting the ideal rate for your car insuranceInsurance coverage Contrast quotes from the leading insurance policy companies. Sales brochure aids you comprehend the function of automobile insurance policy, what is called for by state regulation, optional protection, what to do when you have a mishap and also exactly how to file a claim. accident.

cheap car insurance liability trucks cheap insurance

cheap car insurance liability trucks cheap insurance

Insurance business might factor in their policy costs the driving record of any type of individual of driving age that lives within an insured's household. If you have any type of concerns relating to the potential effect a recently licensed vehicle driver might carry your policy, you might desire to call your insurance coverage representative. It ends with your enrollment and must be paid at renewal. safeguards you if you remain in a crash with someone that doesn't have appropriate insurance policy coverage. Get in touch with your insurance coverage company for the various insurance coverage choices or inspect the Department of Banking and Insurance website See a checklist of authorized firms accepted to create auto responsibility insurance in the Stateof New Jacket. In New Jacket, the insurance policy identifiction card might be presented or given in either paper or electronic kind. For these purposes,"electronic form" indicates the screen of pictures on a digital device, such as a celular telephone, tablet computer or computer. Paper insurance card requirements have actually not transformed. You should maintain the card in the car, or be able togenerate the digital style: Prior to an assessment. Among lots of crucial files that most motorists have in their automobile is their proof of insurance policy. Whether auto insurance coverage is required relies on where you live, however in basic, it's illegal to drive without automobile insurance. The sorts of coverage you require to abide by the regulation vary based upon where you live. In this article, we'll analyze where you may be able to escape not having automobile More helpful hints insurance, in addition to the common fines you can face if you get behind the wheel without insurance coverage in a state that requires it. Virtually every state in the United States needs motorists to bring vehicle insurance. The state does not have a required insurance coverage regulation, yet it"strongly suggests"that locals bring automobile insurance. And also the Division of Electric Motor Automobiles might require vehicle drivers that have been convicted of particular offenses, such as driving while intoxicated or leaving the scene of a crash, to maintain insurance coverage and file an SR-22. As well as if you're in an accident, you will be accountable for covering accident-related expenditures. To make sure you have the appropriate insurance coverage to drive legitimately where you live, consult your state's DMV. Vehicle insurance coverage requirements differ by state. However, almost all states call for some kind of injury protection as well as property damages coverage. Get in touch with your state's DMV to figure out precisely what coverage you need. Driving without insurance coverage can mean hefty penalties for theuninsured. The results differ by state as well as situation, as well as repeat culprits in some locations may face harsher fines than novice culprits (car insurance). Prepare to pay a fine (car). Numerous states will certainly also suspend your chauffeur's license and also registration, which can cause additional prices to obtain them renewed (insure). Driving without insurance policy is a violation in many states, and also possible penalties vary based on where you live. In some states, uninsured vehicle drivers could hang out behind bars, although it's unlikely for a first offense. If you're a repeat transgressor or cause a severe mishap, you're extra most likely to get prison time. The size of the moratorium differs by insurer as well as state regulation yet generally varies from 7 to one month. Inspect with your insurance company to learn if you have a moratorium as well as the length of time it is.