Hail, flooding and even wind can do serious damage to a car, and your insurance provider will be on the hook to repair or change it if you have thorough coverage. "If you reside in a state where storms are frequent, Florida, Oklahoma and Texas are great examples, insurer need to charge more due to the fact that they get more claims," says Gusner.

Here are a couple of state elements that influence vehicle insurance coverage expenses: Each state sets its own insurance coverage requirements and guidelines, and both can affect rates in the state. Michigan utilizes a very special no-fault system that has actually resulted in sky-high rates for many years. Recent changes to their system are accountable for their drop to second location this year. car insured.

"States that require more coverages, such as accident defense that Michigan and Florida (this may be altering quickly in Florida) need, wind up costing chauffeurs more in regards to insurance premiums," keeps in mind Gusner - insurance company. Uninsured drivers raise rates for everyone as insurance provider tend to pass the cost of uninsured drivers onto insured drivers.

Here are the leading three most pricey states for vehicle insurance: Rank, The majority of expensive states for cars and truck insurance coverage 123 # 1 Help might be on the way This year, Louisiana moved into the top position, dethroning Michigan as the long-lasting king of high cars and truck insurance rates. The Pelican State is no stranger to our list; it has actually been in the top five almost every year we have actually done the research study and in the leading three given that 2017.

In a year when most states saw rate declines, the cost of automobile insurance in Louisiana bumped up 19%. In Louisiana, uninsured and underinsured drivers integrated with easy suits are the significant factors in pushing up rates. According to the III, it is estimated that 11. 7% of motorists in the state are travelling the roadways uninsured.

Chauffeurs with little to no insurance get into accidents and then sue each other in front of elected judges who are more than pleased to side with motorists over insurance business; the huge loser is vehicle insurance rates. This legal circumstance can lead to big accident settlements and insurance companies pass those expenses onto all drivers by means of higher premiums - vehicle insurance.

The law used to enable a complainant to recuperate the total quantity billed and neglect any discount worked out by an insurance business. There is a dramatic difference in between the amount a health center charges and what an insurance coverage company actually pays for medical costs due to negotiated discounts.

What Is The Average Cost Of Auto Insurance? - Moneygeek Fundamentals Explained

"These reforms have simply entered into force in Louisiana," states Gusner. "It may take a couple of years for rates to come down with existing insurers as they see claim settlement amounts decreased. Likewise, the hope is more insurance companies will desire to offer policies in Louisiana now. This would make the car insurance coverage market more competitive and must result in lower rates provided to motorists." In spite of current modifications, automobile insurance coverage is still expensive This is the very first time in 8 years that Michigan has not been at the top of the list, and its transfer to 2nd location is based upon a technicality.

"We did see almost a 30% decrease in rates for changing from endless PIP to a cap of $250,000, however I would hope by next year to see the rates fall a lot more as the cost savings go up. car." Older chauffeurs, lots of colleges, and loads of uninsured chauffeurs Florida stayed in third place for the fifth year in a row.

An extremely current modification to car insurance laws effect future expenses, however some worry it may push some rates even greater. 4% of chauffeurs in Florida are out on the road without protection which is one of the greatest rates in the nation.

In addition to tons of uninsured chauffeurs, Florida is likewise packed with older drivers, students (dozens of colleges in Florida) along with a lot of tourists. All of these are considered higher-risk drivers, which results in mishaps, claims and greater premiums for citizens. Another factor is the weather. Hurricanes and hailstorms can cause significant automobile damage and insurers need to fix or replace those lorries.

This is 40% less than the nationwide average. The vehicle insurance situation in Maine is basically the same as last year, according to Judi Watters, consumer outreach expert with the Maine Bureau of Insurance Coverage. "Maine's traditionally low car insurance losses have actually helped to keep premiums low, as has the state's competitive vehicle insurance market." Low density and a lot of insured motorists assist driver low insurance coverage rates.

According to the III, just 4. insurance companies. 9% of the motorists in Maine are uninsured. With fewer uninsured drivers on the roadway, rates are lower for everyone. New Hampshire remained in 2nd location for the second year in a row. The average premium in the Granite state dipped 10% this year to $885, 38% less than the national average.

1% of drivers out on the roadway without protection. According to the Guv, New Hampshire likewise gains from excellent drivers and safe roadways. "New Hampshire has some of the best chauffeurs in America, and since our roads are so safe, customers are enjoying the advantage with some of the least expensive car insurance rates in the country," said Guv Chris Sununu in a recent news release.

Some Known Questions About Best Car Insurance Companies Of April 2022 – Forbes Advisor.

Auto insurance rates in Wisconsin dropped a tremendous 11% from last year, with a typical premium coming in at $938 this year. Wisconsin gain from a range of elements while likewise needing to deal with weather condition issues and a number of big cities. "Stable regulation and a competitive market are key to our state's success - dui.

This factor doesn't appear to result in sky-high car insurance rates. How to get the finest cars and truck insurance coverage rates?

Below are the steps to find the finest automobile insurance coverage rates: 1. There are a couple of things that need to come in convenient prior to starting to go shopping for vehicle insurance coverage quotes.

Unless you live in New Hampshire, your state needs a minimal amount of physical injury and residential or commercial property damage liability insurance. Your state may also require medical protection or underinsured/uninsured driver insurance.

It also does not compensate you if you trigger a mishap or come across environmental damage while driving. It is recommended to have higher protection, as it provides more security, but at a higher cost. 3. When you have determined what are the important things needed to get automobile insurance and how much coverage you require, the next step is to search for automobile insurance quotes.

The age and gender of the chauffeur also contribute to computing the insurance rates. Teenager chauffeurs have greater rates, as they are considered to have greater possibilities of getting into a mishap and are likely to file a claim.

Cars and truck insurance coverage differs by state for a couple of factors. These laws mandate the minimum car insurance coverages and limits a vehicle owner must carry on their vehicle.

The smart Trick of When Does Car Insurance Cost Go Down? - The Balance That Nobody is Discussing

Our study attempted to make it more of an apples-to-apples comparison by looking at the very same amount of protection of liability in each state (100/300/50), having uninsured vehicle driver of 100/300 plus compensation and crash protections. This then highlights the bonus some states need that push rates higher, like the PIP requirements in Michigan and Florida.

State laws also direct insurance provider on what they can and can not rate chauffeurs on and that affects rates. While all states permit particular danger aspects to be looked at, such as your driving record, there are some aspects that some states have actually restricted, such as credit report, gender and age. cheapest car.

What states have the most affordable cars and truck insurance coverage rates? Most of the states with the lowest car insurance coverage rates are smaller and less populated.

The states mentioned below have the least expensive cars and truck insurance rates: Maine New Hampshire Wisconsin How to decrease car insurance coverage rates? You can not always manage every aspect that affects your cars and truck insurance rates, but there are things you may do to conserve cash. prices. Keeping car insurance rates low by improving your driving habits and credit rating, seeking discount rates, and making use of usage-based insurance (pay per mile) are all alternatives.

If you do not drive much, go with pay-per-mile insurance coverage. Here you pay a month-to-month base rate plus a per-mile cost. Selecting any of these above-mentioned hacks can assist you save some money on your insurance coverage premiums. Conserve money on automobile insurance rates in any state Regardless of where you live, finding cheaper insurance coverage is constantly a winning strategy.

They are patronizing a minimum of 3 insurance providers for coverage and rates, raising the deductible, utilizing usage-based coverage, and using all the available discount rates. This is often the best way to decrease your premium. Insurance companies rate danger in a different way, so there can be dramatic distinctions in premium quotes. Shop at least three insurers and always make certain you're comparing apples to apples when it pertains to coverage levels and deductibles.

Any life occasion is an excellent factor to search looking for a much better deal on cars and truck insurance. "Constantly look around when there is a life event that would trigger rate modifications," recommends Gusner. credit score. "This could be a wedding event, a teen going on your policy, including a car, getting rid of a cars and truck or perhaps needing to sue on your policy.

The Greatest Guide To What Is The Average Car Insurance Cost Per Month? - The ...

Contact your insurance company or representative to make certain all readily available discounts are being applied to your policy. Doubling your deductible can be a great way to decrease your premium if you can afford it. Always pick a deductible that you can easily pay for in case you have to make a claim - vehicle.

The rate consists of uninsured motorist coverage. Real rates will depend upon private driver aspects. We averaged rates in each state for the cheapest-to-insure 2021 model-year variations of America's 20 very popular lorries as of Jan. 2021 and ranked each state by that average. Rates are for relative functions only within the very same model year.

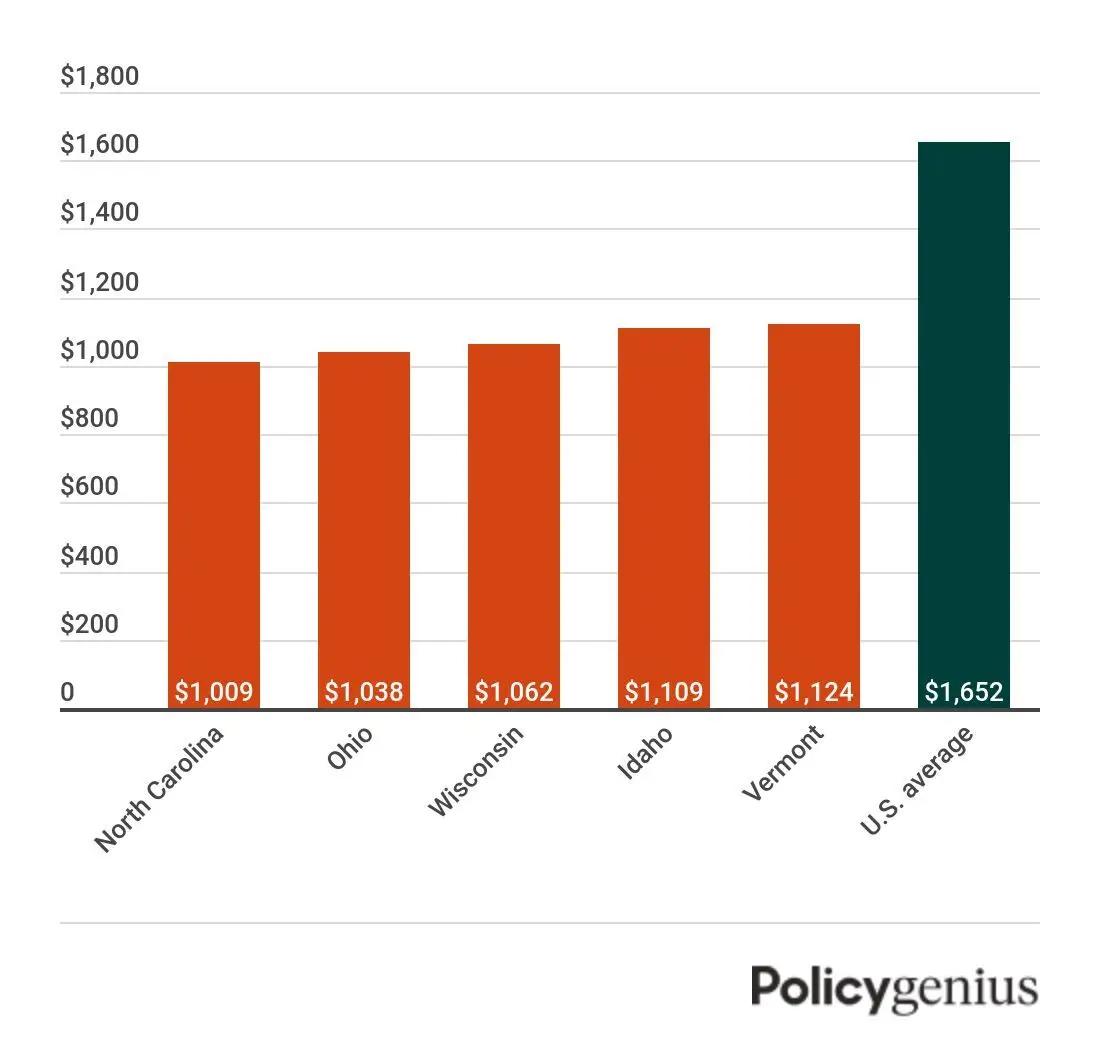

The NAIC's numbers show the average quantity that mention homeowners spend for automobile insurance coverage, despite the type of cars and truck they insure or quantity of coverage they acquire. Frequently asked concerns What states have the cheapest automobile insurance rates? Our study reveals that the leading 5 most affordable states for car insurance coverage in 2021 are: Maine, New Hampshire, Wisconsin, Idaho, Ohio Cheaper mentions for vehicle insurance tend to have lower population density and a competitive market for automobile insurance coverage. car insurance.

What states have no car insurance? A few states do not directly state in their laws you must buy car insurance coverage, New Hampshire, Tennessee and Virginia are the primary ones; however, all states need you to have means for financial responsibility if you remain in an accident. The easiest way to reveal financial duty is with an automobile insurance coverage policy (automobile).